real estate tax shelter example

Texas has some of the highest property taxes in the entire country. One of the most basic components everyone deserves in the simplest terms is shelter.

9 Legal Tax Shelters To Protect Your Money Gobankingrates

To begin with what are tax shelters.

. Tax shelters can range from investments or. If you earn 20000 annually for example and utilize tax shelters worth 5000 your taxable income reduces to 15000 leading to tax deductions of 5000. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a.

How Does an Abusive Tax Shelter Work. While for the most part the national average as far as property taxes go sits around 12 its upwards of. States counties or municipalities can impose RETs.

Key Takeaways A tax shelter is a place to legally store assets so that. An abusive tax shelter is an investment strategy that illegally shields assets from tax liability. Real estate tax shelter example.

In this article well. This is mainly due to its generous tax benefits. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges.

Here are nine of the best tax shelters you can use to reduce your tax burden. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property. Impact of Oil Price Decline on Construction and Real Estate.

Set Up a Retirement Account. In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities.

Historically real estate has proved to be a significant tax shelter. 23 Returns Last Year. Real Estate Center at Texas AM University.

Free shipping and returns on all orders over 120 bukit brown cemetery exhumed. Breathing room yoga new haven. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b.

Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another. Either a single-family residence a multi-family duplex or a mixed-use apartment. A 401 k or other type of tax-deferred retirement account like an IRA.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more. Tax Lien Examples - Learn the facts of investing in tax lien certificates.

Tax Shelters Definition Types Examples Of Tax Shelter

Tax Shelters For High W 2 Income Every Doctor Must Read This

The Incredible Tax Benefits Of Real Estate Investing

Tax Shelters For High W 2 Income Every Doctor Must Read This

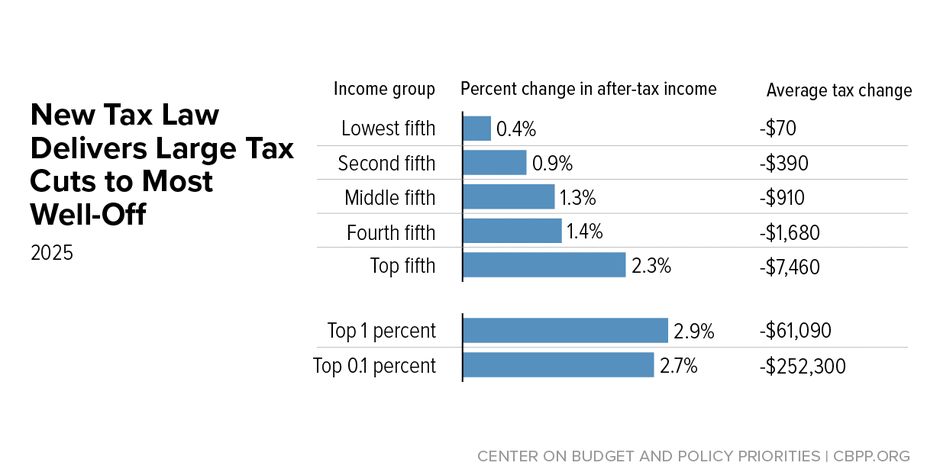

New Tax Law Is Fundamentally Flawed And Will Require Basic Restructuring Center On Budget And Policy Priorities

Tax Shelters For High W 2 Income Every Doctor Must Read This

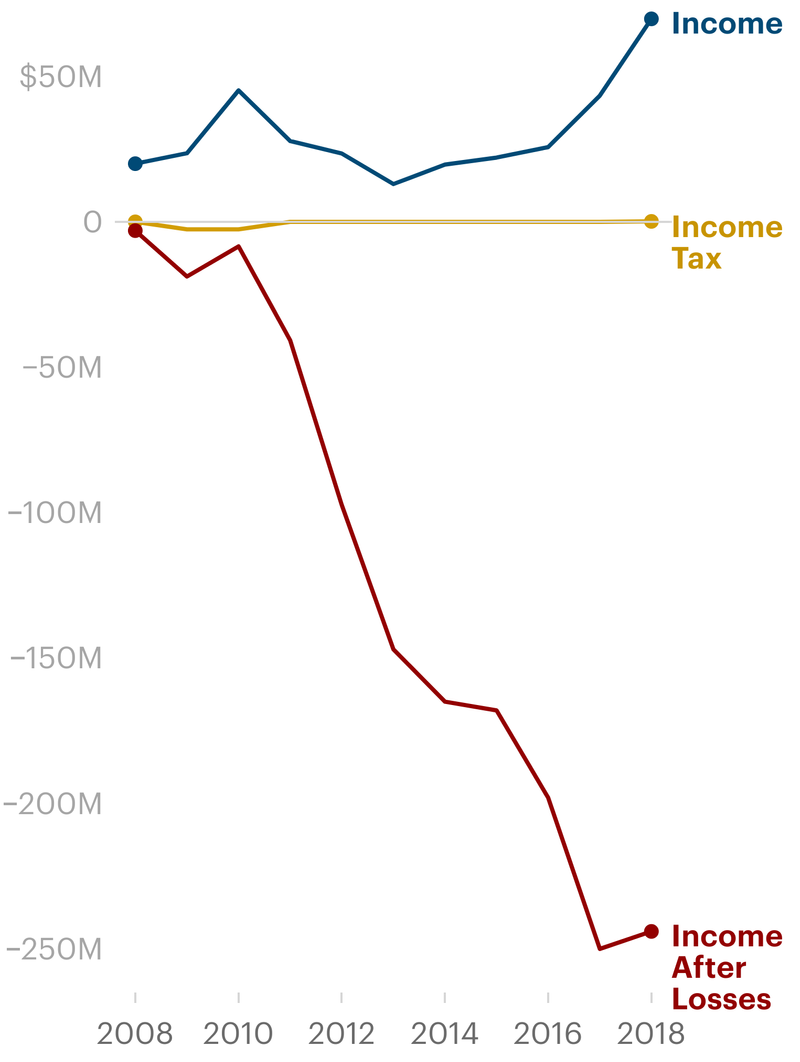

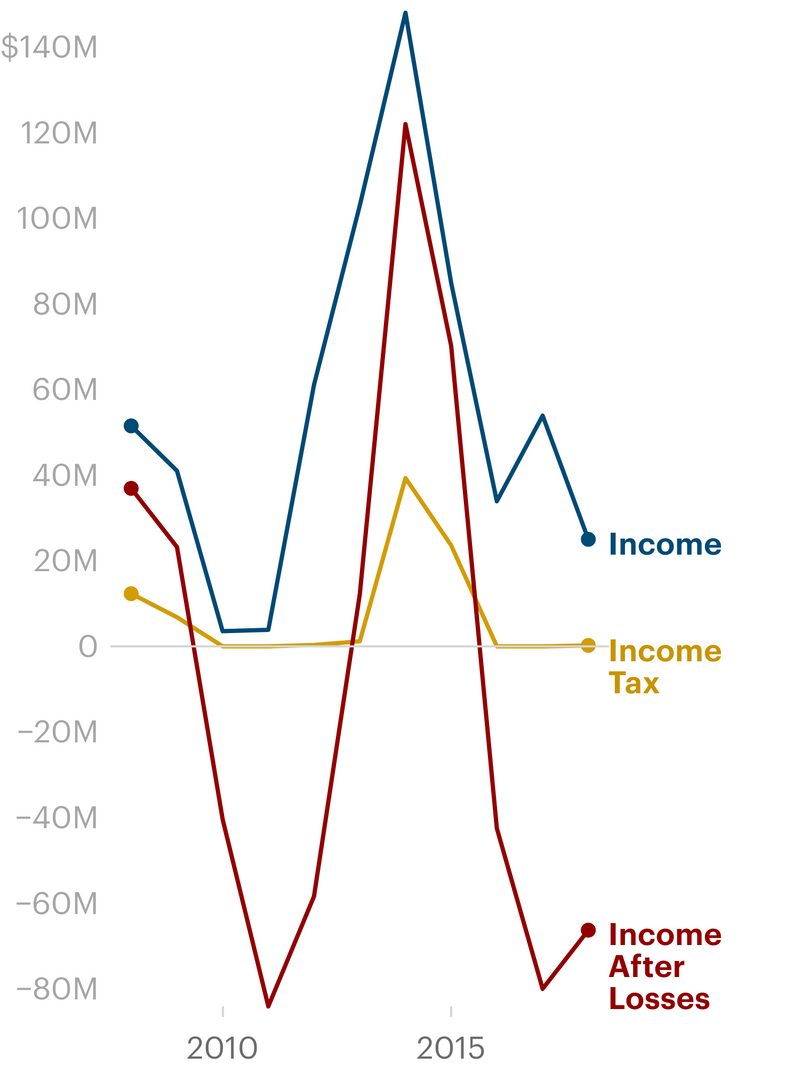

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

How To Avoid Estate Taxes With A Trust

How Do State And Local Property Taxes Work Tax Policy Center

What Is The Biggest Tax Shelter For Most Taxpayers

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Tax Shelters For High W 2 Income Every Doctor Must Read This

A Primer On Real Estate Professional Status For Doctors Semi Retired Md

What S The Difference Between Front Loaded And Back Loaded Retirement Accounts Tax Policy Center

The Best Tax Benefits Of Real Estate Investing Fortunebuilders